43 coupon rate semi annual

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. Interest Rate Converter | Convert annual to monthly, semi ... For example, if you need to compare an interest rate of 12% p.a., payable monthly with an interest rate of 12.50% p.a., payable annually to find which one is expensive in terms of effective cost, convert the former into annual one or the latter into monthly one using this tool - to check out which one is more (or less) expensive than the other.

How to convert the effective semi-annual rate to APR - Quora Answer (1 of 4): You're all getting EAR and APR confused. The annual percentage rate (APR) is the annual rate ignoring compounding, and the effective annual rate (EAR) is the annual rate with compounding. So if you have a monthly rate of 1% interest, the APR is 12 x 1% = 12%, while the EAR is (...

Coupon rate semi annual

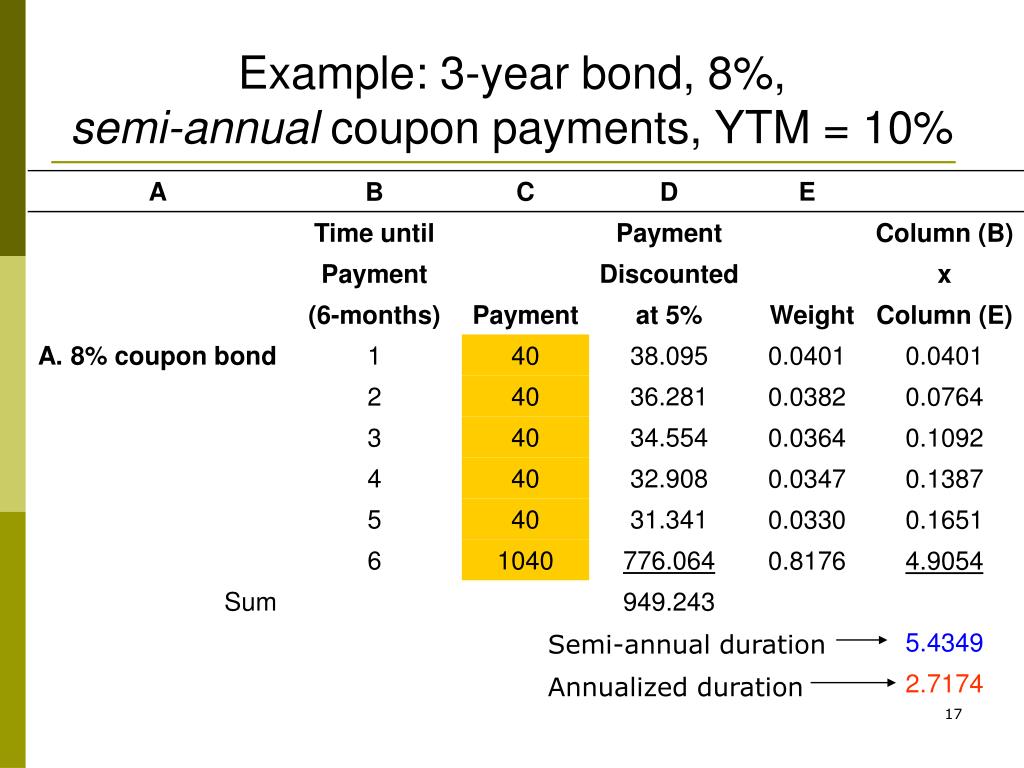

Coupon Rate - Meaning, Calculation and Importance The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Coupon Rate Calculator. This calculator calculates the coupon rate using face value, coupon payment values. A $100 face-value bond has 10 years to mature. It | Chegg.com It pays semi-annual coupon interest at the rate of 5% p.a. and its yield to maturity is 7% p.a. What is the duration of this bond in years? Question: A $100 face-value bond has 10 years to mature. It pays semi-annual coupon interest at the rate of 5% p.a. and its yield to maturity is 7% p.a.

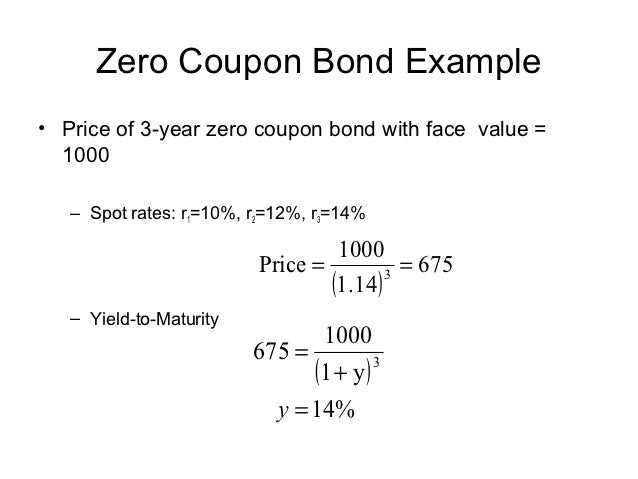

Coupon rate semi annual. Buying a $1,000 Bond With a Coupon of 10% - Investopedia Most bonds pay interest semi-annually, which means bondholders receive two payments each year. 1 So with a $1,000 face value bond that has a 10% semi-annual coupon, you would receive $50 (5% x... Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Suppose you have a bond and its face value is $1000 with the present price of $900, and the coupon rate is 2%. Its maturity period is also five years. So, when we calculate the semi-annual bond payment, first of all, we have to get 2% of the face value of $1,000, which is $20, and after that, we have to divide it by two. How to Calculate Semi-Annual Bond Yield | The Motley Fool Nov 25, 2016 · Its coupon rate is 2% and it matures five years from now. To calculate the semi-annual bond payment, take 2% of the par value of $1,000, or $20, and divide it by two. The bond therefore pays $10... Certified Semi-annual Shareholder Report for Management ... 11.3.2022 · Certified Semi-annual Shareholder Report for Management Investment Companies (n-csrs) March 11 2022 - 08:25AM Edgar (US Regulatory) UNITED ... Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions.

How to Calculate a Coupon Payment: 7 Steps (with Pictures) 3. Calculate the payment by frequency. Since bondholders generally receive their coupon payments semiannually, you just divide the annual coupon payment by two to receive the actual coupon payment. For example, if the annual coupon payment is $80, then the actual coupon payment is $80/2 or $40. Advertisement. CD Calculator: Estimate Certificate of Deposit Returns A crucial point of comparison between lenders’ offers, will be the APY, or annual percentage yield offered by the CD. This is a number that reflects both the interest rate AND the frequency of compounding during a 365-day period. Yield to Maturity (YTM): Formula and Excel Calculator Semi-Annual Coupon Rate (%) = 6.0% ÷ 2 = 3.0%; Then, we must calculate the number of compounding periods by multiplying the number of years to maturity by the number of payments made per year. Number of Compounding Periods (n) = 10 × 2 = 20; As for our last input, we multiply the semi-annual coupon rate by the face value of the bond (FV) to ... Effective Yield Definition 23.3.2020 · The effective yield is a measure of the coupon rate, which is the interest rate stated on a bond and expressed as a percentage of the face value. Coupon payments on a bond are typically paid semi ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. Semi-annual rate - ACT Wiki The semi-annual rate is the simple annual interest quotation for compounding twice a year. Coupon rates on bonds paying interest twice per year are generally expressed as semi-annual rates. This makes rates broadly comparable, while also enabling the amounts of fixed interest coupons to be determined easily. Example: Semi-annual rate calculation Semiannual coupon and annual coupon | Forum | Bionic Turtle So the rate is 5% per semiannual period which is used to pay coupon at end of each half year. so that for a bond with face value 100 with 10% semiannual couponsmeans that coupons are paid semiannually (at end of each half year) at 10/2%=5% which is (5/100)*100=5 , so the semiannual coupon is 5% because the rate 10% is compounded semiannually. How To Calculate Interest Compounded Semiannually (With ... How to calculate interest compounded semiannually. The formula for compounded interest is based on the principal, P, the nominal interest rate, i, and the number of compounding periods. The formula you would use to calculate the total interest if it is compounded is P[(1+i)^n-1]. Here are the steps to solving the compound interest formula:

Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k each year for as long as the bond is still outstanding. Number of Periods (N) = 2 Coupon Payment = $6,000 / 2 = $3,000 Bond Coupon Rate Calculation Steps

Coupon Rate Formula | Step by Step Calculation (with Examples) Dave said that the coupon rate is 10.00% Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct.

Bond Prices: Annual Vs. Semiannual Payments | Pocketsense The more frequent a bond pays its coupon payments, the higher the effective yield of the bond under the same annual coupon rate. If a bond pays coupon interest semiannually instead of annually, it will compound interest twice rather than once, increasing total bond returns at the end of a year.

How to Calculate Semi-Annual Bond Yield | Nasdaq Its coupon rate is 2% and it matures five years from now. To calculate the semi-annual bond payment, take 2% of the par value of $1,000, or $20, and divide it by two. The bond therefore pays $10 ...

Annual Salary to Biweekly Paycheck Conversion Calculator Semi-Annually: Annually: Hours worked per year: This calculator will help you to quickly convert your annual salary into the equivalent hourly income. Simply enter your annual income along with your hours per day, days ... If your effective income tax rate was 25% then you would subtract 25% from each of these figures to estimate your biweekly ...

Coupon Rate Definition - investopedia.com A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Coupon Bond Formula | How to Calculate the Price of Coupon ... Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd.

Solved Suppose a seven-year, $1,000 bond with a 7% coupon ... Expert Answer No of periods = 7 years * 2 = 14 semi-annual periods Coupon per period = (Coupon rate / No of coupon payments per year) * Par value Coupon per period = (7% / 2) * $1000 Coupon per period = $35 a) Bond Price = Co … View the full answer Previous question Next question

Post a Comment for "43 coupon rate semi annual"