38 us treasury bonds coupon rate

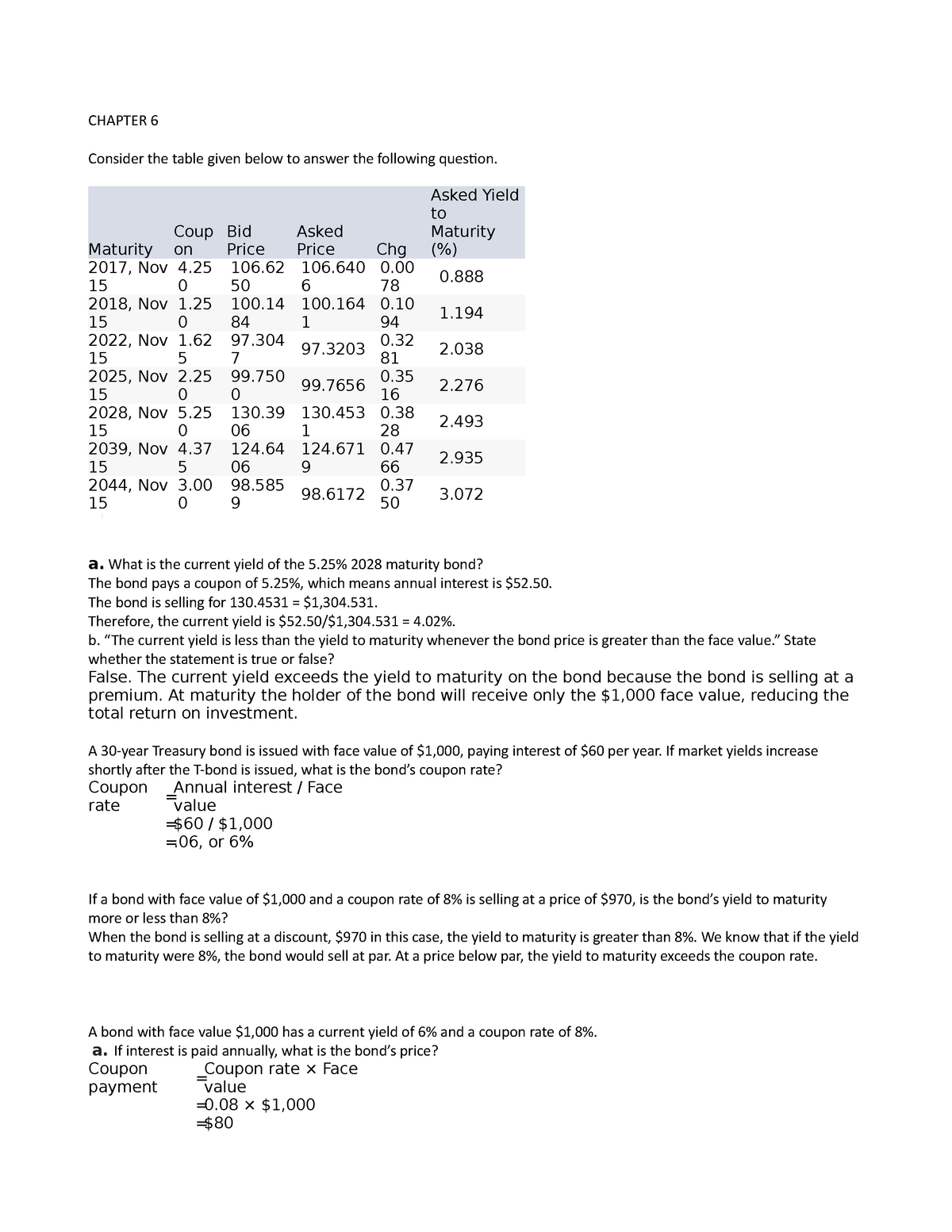

Stock Market Data – US Markets, World Markets, After Hours ... Stock market data coverage from CNN. View US markets, world markets, after hours trading, quotes, and other important stock market activity. How to Buy US Treasury Bonds (…And SHOULD You…??) Dec 22, 2021 · Unlike stocks, there isn’t a huge difference in price with bonds. Par is $100, the face value that US Treasury Bonds sell for. If the coupon rate is higher than the interest rate, they will add a premium. So, if a coupon price is paying 5.25% and the interest on the bond is only 1.4%, you’ll pay more per bond than $100.

How Is the Interest Rate on a Treasury Bond Determined? A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. Treasury bonds also are traded in ...

Us treasury bonds coupon rate

United States Treasury security - Wikipedia Treasury Inflation-Protected Securities (TIPS) are inflation-indexed bonds issued by the U.S. Treasury. Introduced in 1997, they are currently offered in 5-year, 10-year and 30-year maturities. The coupon rate is fixed at the time of issuance, but the principal is adjusted periodically based on changes in the Consumer Price Index (CPI), the ... United States Rates & Bonds - Bloomberg.com Treasury Yields ; 0.00, 4.31, 4.51%, +51 ; 4.25, 99.59, 4.47%, +35 ... Understanding Pricing and Interest Rates - TreasuryDirect During the life of the bond or note, you earn interest at the set rate on the par value of the bond or note. The interest rate set at auction will never be ...

Us treasury bonds coupon rate. US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. Interest Rate Statistics | U.S. Department of the Treasury These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal ... US Treasury Series I Savings Bonds Inflation Rate Earnings ... Apr 28, 2022 · US government [treasurydirect.gov] is expected to pay 9.62% on its I-bonds in combined Fixed + Inflation Rate Earnings valid on newly issued Series I Savings Bonds purchased 05/01/22-10/30/22. In Slickdeals Forums Hot Deals US Treasury Series I Savings Bonds Inflation Rate Earnings (May - October '22) 9.62% Interest (Annualized for 6 Months ... How to Buy Treasury Bonds: Prices & Options for Beginners Jul 20, 2022 · I-Bonds purchased now through October 2022 will have a 9.62% Interest Rate guaranteed for 6 months. Future changes in rates are not disclosed by the US Treasury. Types of Treasury bonds

Understanding Treasury Bond Interest Rates | Bankrate 2 Nov 2021 — Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every ... Foreign Account Tax Compliance Act | U.S. Department of the ... Aug 18, 2015 · FATCA requires foreign financial institutions (FFIs) to report to the IRS information about financial accounts held by U.S. taxpayers, or by foreign entities in which U.S. taxpayers hold a substantial ownership interest. FFIs are encouraged to either directly register with the IRS to comply with the FATCA regulations (and FFI agreement, if applicable) or comply with the FATCA Intergovernmental ... Treasury Bonds - TreasuryDirect The rate is fixed at auction. It does not vary over the life of the bond. It is never less than 0.125%. See Interest rates of recent bond auctions. Understanding Pricing and Interest Rates - TreasuryDirect During the life of the bond or note, you earn interest at the set rate on the par value of the bond or note. The interest rate set at auction will never be ...

United States Rates & Bonds - Bloomberg.com Treasury Yields ; 0.00, 4.31, 4.51%, +51 ; 4.25, 99.59, 4.47%, +35 ... United States Treasury security - Wikipedia Treasury Inflation-Protected Securities (TIPS) are inflation-indexed bonds issued by the U.S. Treasury. Introduced in 1997, they are currently offered in 5-year, 10-year and 30-year maturities. The coupon rate is fixed at the time of issuance, but the principal is adjusted periodically based on changes in the Consumer Price Index (CPI), the ...

:max_bytes(150000):strip_icc()/GettyImages-172745598-5756f5bd3df78c9b46977f64.jpg)

Post a Comment for "38 us treasury bonds coupon rate"